Crypto moves fast—one day, a project is under the radar, and the next, it’s making millionaires. If you’re looking for the top altcoins to invest in this week, you’re in the right place.

There are plenty of good options, but one project is standing out from the crowd. Meet Qubetics ($TICS)—the first Real World Asset (RWA) Tokenization Marketplace that’s turning traditional assets into digital investments on the blockchain.

With a booming presale and analysts predicting a 16,791% ROI, Qubetics is a must-watch project before its Q2 2025 mainnet launch. But that’s not all—Hedera, Litecoin, Filecoin, and Cosmos are also making waves this week.

Let’s dive in.

1. Qubetics ($Tics) – Real-World Asset Tokenization Is The Future

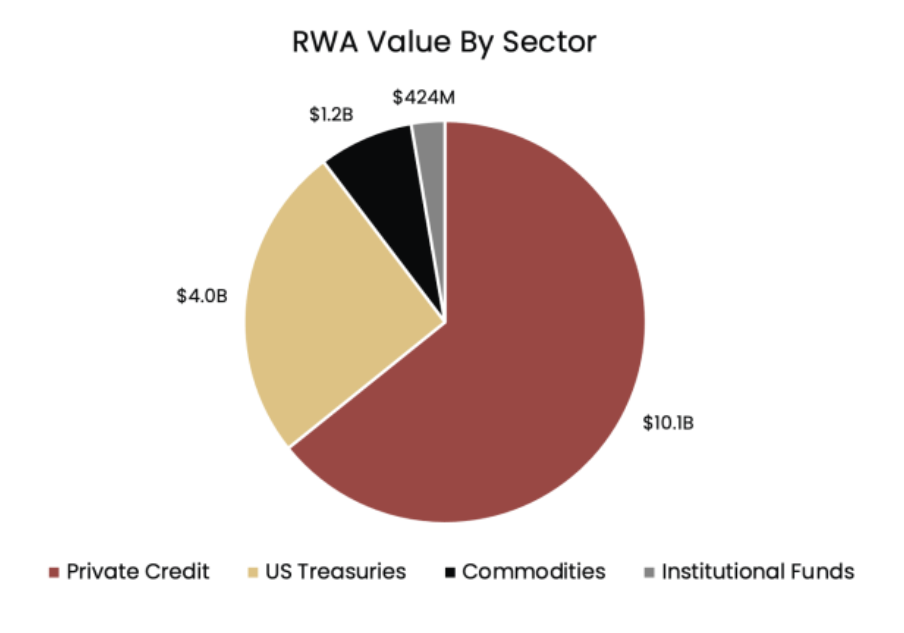

Imagine owning a fraction of a luxury skyscraper, a rare piece of art, or a gold reserve—all with a few clicks. That’s exactly what Qubetics ($TICS) is making possible with its Real World Asset Tokenization Marketplace.

Right now, traditional investments are limited to the wealthy. Real estate, fine art, commodities—these are locked behind high barriers of entry. But Qubetics breaks down these walls, allowing anyone to own a slice of high-value assets by tokenizing them on the blockchain.

Let’s say a developer in Dubai wants to fractionalize a multi-million-dollar hotel. Instead of selling to one wealthy buyer, they can tokenize ownership, allowing thousands of people to invest in shares.

Or think about a gold investor who doesn’t want to store physical gold bars. Through Qubetics, they can own tokenized gold that’s securely tracked and traded without the need for third-party vaults.

This is why Qubetics is one of the top altcoins to invest in this week—it’s bridging the gap between traditional finance and blockchain technology.

Qubetics Presale: Time Is Running Out

Qubetics’ presale is on fire, with over $14.2M raised and more than 21,600 holders securing their spot before prices increase every Sunday at 12 AM.

Here’s the latest:

- Current Price: $0.0888

- Total Raised: $14.2M+

- Tokens Sold: 491M+

- Mainnet Launch: Q2 2025

And here’s what analysts predict:

- $TICS at $0.25 (presale end) → 181.52% ROI

- $TICS at $1 (after presale) → 1,026.09% ROI

- $TICS at $15 (after mainnet) → 16,791.32% ROI

A $1,000 investment at today’s price ($0.0888) could turn into $168,000 if Qubetics hits $15 post-launch. That’s why it’s the best crypto presale to invest in right now. Don’t miss out—join the Qubetics presale before the next price hike!

2. Hedera (Hbar) – The Enterprise Blockchain Leader

Hedera (HBAR) is making serious moves in enterprise blockchain adoption, working with major companies like Google, IBM, and Boeing to bring secure and scalable DLT solutions to businesses.

Unlike traditional blockchains, Hedera uses Hashgraph technology, which processes transactions at lightning speed with ultra-low fees. This makes it ideal for large-scale corporate applications, from supply chain tracking to digital identity management.

Hedera is positioning itself as the go-to network for enterprises, making it one of the top altcoins to invest in this week.

3. Litecoin (Ltc) – The Og Of Fast & Cheap Transactions

Litecoin has been around for over a decade, proving itself as one of the most reliable digital payment networks. With faster block times and lower fees than Bitcoin, LTC remains a go-to option for merchants and crypto users worldwide.

Recent updates, including MimbleWimble for enhanced privacy transactions, have given Litecoin a fresh boost in adoption. It may not have the hype of newer projects, but its stability, real-world use case, and continued relevance make it a solid pick this week.

4. Filecoin (Fil) – Decentralized Storage Is Booming

With data storage demand exploding, Filecoin (FIL) is stepping up as the leading decentralized storage solution. Instead of relying on centralized providers like Google Drive or AWS, Filecoin allows users to rent out unused storage space, creating a decentralized, censorship-resistant cloud storage network.

With Web3 adoption on the rise, Filecoin is poised for long-term growth, making it one of the top altcoins to invest in this week.

5. Cosmos (Atom) – The Interoperability King

Cosmos (ATOM) is solving one of the biggest problems in crypto—blockchain interoperability. Right now, most blockchains operate in silos, making cross-chain transactions slow and expensive.

Cosmos is fixing this by allowing blockchains to communicate seamlessly, enabling frictionless transfers of assets and data across different networks. With over 250 dApps already built on Cosmos, it’s quickly becoming a core player in the future of multi-chain ecosystems.

That’s why Cosmos is a must-watch altcoin this week.

Final Thoughts: Which Altcoin Is The Best Pick?

Hedera is making big moves in enterprise blockchain, Litecoin is still a digital payments powerhouse, Filecoin is pushing decentralized storage, and Cosmos is leading the charge on interoperability.

But the real breakout star? Qubetics ($TICS).

With its Real World Asset Tokenization Marketplace, cross-border investment revolution, and massive presale momentum, Qubetics is easily one of the top altcoins to invest in this week.

Time is running out—join the Qubetics presale before the next price increase!

For More Information:

Qubetics:

Telegram:

Twitter: https://twitter.com/qubetics

For Publishers:

Alt Text: Top altcoins to invest in this week, best crypto presale to join, Qubetics price prediction, real-world asset tokenization, Hedera enterprise adoption, Litecoin digital payments, Filecoin decentralized storage, Cosmos blockchain interoperability, crypto presale 2025.

FAQs

1. Why is Qubetics one of the top altcoins to invest in this week?

Qubetics is leading the Real World Asset Tokenization revolution, allowing anyone to own tokenized shares of real estate, commodities, and other assets. With a presale raising over $14.2M and a Q2 2025 mainnet launch, it has huge potential for early adopters.

2. How does the Qubetics presale work?

The presale runs in weekly stages, with a 10% price increase every Sunday at 12 AM. Right now, Stage 23 is live, meaning the price will increase soon—so early buyers get the best deal.

3. How much could a $1,000 investment in Qubetics be worth?

At $0.0888 per token, a $1,000 investment today would get you 11,261 $TICS tokens. If $TICS hits $10 post-mainnet launch, that would be $112,610—and at $15, it skyrockets to $168,000.